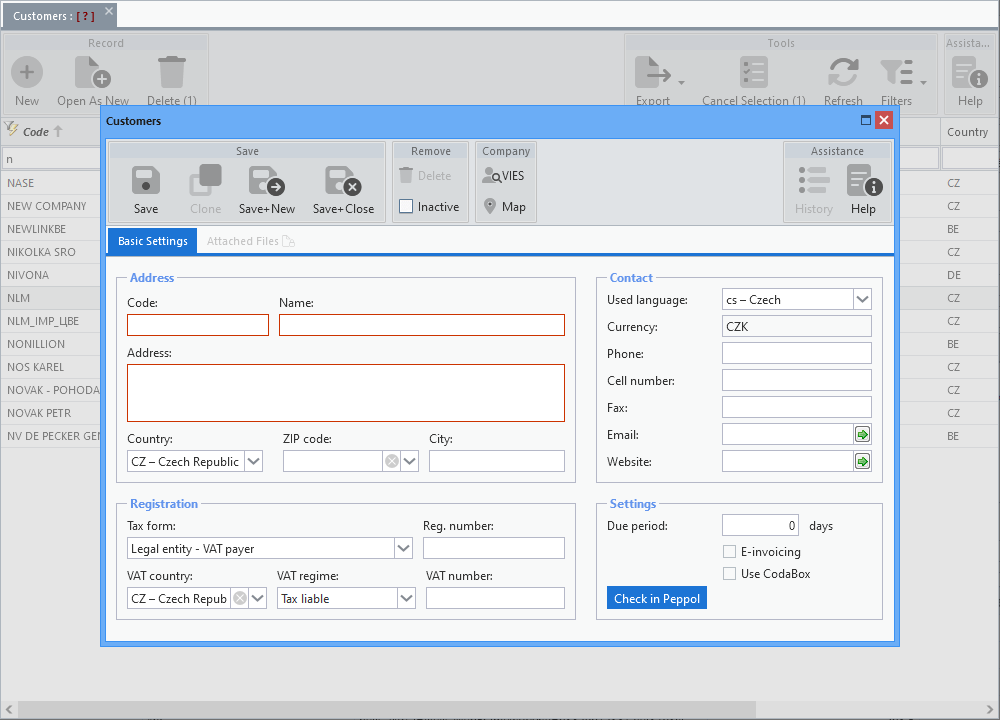

Application for registration of customers (purchasers). The assigned Code is chosen by the user at his discretion (usually an abbreviation of the customer's name) and is automatically converted to capital letters after entry. It is used for easier customer identification, e.g. in document overviews and saves space in printouts.

After opening a blank form to create a new record, some input values are pre-filled according to the default settings for the new customer. Since only one currency can be invoiced in Subito, the Currency input field is read-only. Mandatory input fields are highlighted in red.

The ZIP code can be selected from the postcode database, which is already filtered according to the entered country. After selecting from the list, the City input is also automatically filled in. However, both entries can be edited as needed and you can also enter a zip code or city that is missing from the database. The database is populated from publicly available registers and cannot be edited in Subito.

When entering the required data, it is necessary to pay special attention to the Registration section and especially to the correct setting of the Tax form and VAT regime. The list of possible values for these inputs is fixed and cannot be edited or extended.

The buttons at the end of the Email and Website inputs open the email client with the pre-filled address according to the input value, respectively the web browser with the page loaded according to the specified address.

Setting due days for a given customer is used to automatically calculate the due date when issuing invoices. If the data is not set, or value is zero, the Due date category in the default settings is used.

The E-invoicing option ensures that an ISDOC file is generated and attached to the message when sending an invoice by email. If the option Attach XML file (e-invoicing) is checked in the Subitodefaults, this setting applies to all customers and it is not necessary to specify it for each one separately. This would only make sense if not all customers require this file. Then it is necessary to disable this option in the default settings and define it for each customer as needed.

The Use CodaBox option is useful for Belgian Subito users. This is a service that allows Belgian accounting firms to access their clients' bank information and statements.

The Check in Peppol button is intended for Subito users abroad and, based on the entered VAT number, determines the ability to communicate with the customer through this service. Peppol is a secure international network that allows companies and entrepreneurs to exchange documents and data with any other entity registered in this network. This protocol is not yet used in the Czech Republic.

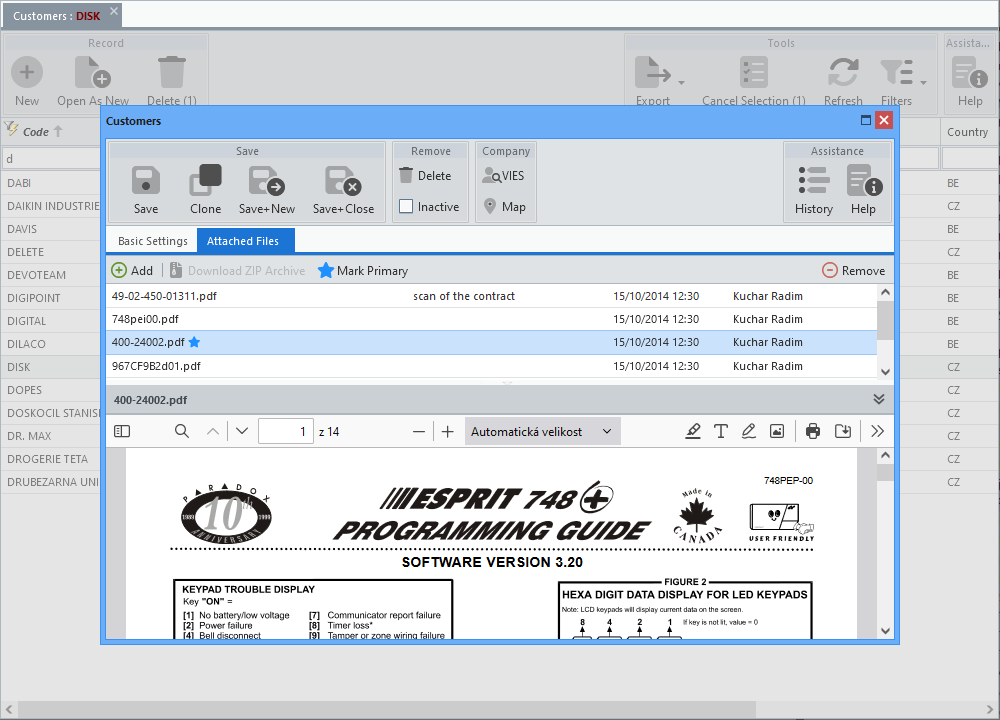

Attached files

The Attached Files tab offers the possibility to save various files to the customer and possibly mark one of them as the default (a general functionality of the file panel, which, however, has no use for the time being). In case of a new record, the tab is available only after the data of the first tab has been saved.

By clicking on the line in the second column, the editing field opens and the attached file can be given a short description. Double-clicking on the other columns will then trigger the file download.

When more than one file is selected (by clicking on a line with the Ctrl or Shift key held down), the option to download the selected files in a compressed ZIP archive is enabled.

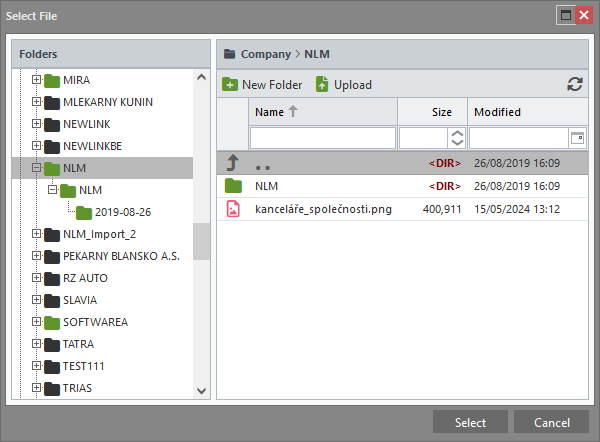

The file to be attached must be registered in the Allegro file manager, which opens by clicking the Add button (more in the separate manual - chapter File Manager). If it is a new file, it can be inserted into the file manager using the Upload button (see file selector below).

File selector

Toolbar

The standard tools are complemented by buttons included in the Company group. For more information about the standard toolbar, see the separate manual - chapter Toolbar.

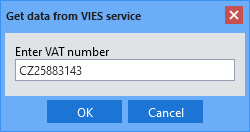

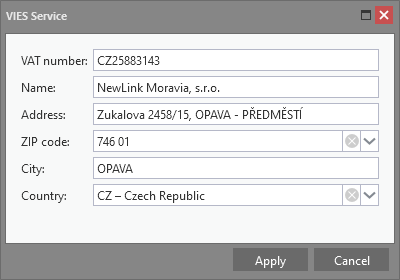

The button is mainly used during the customer creation. After entering the VAT number, it allows to retrieve data from the VIES search engine (VAT Information Exchange System operated by the European Commission). In this service, the data is retrieved from national VAT databases and, once obtained, can be inserted into the form without the need for manual entry.

If the VAT number is already entered on the form, it is automatically inserted into the query.

Inquiry the VIES service

VIES response with option

to load data into the form

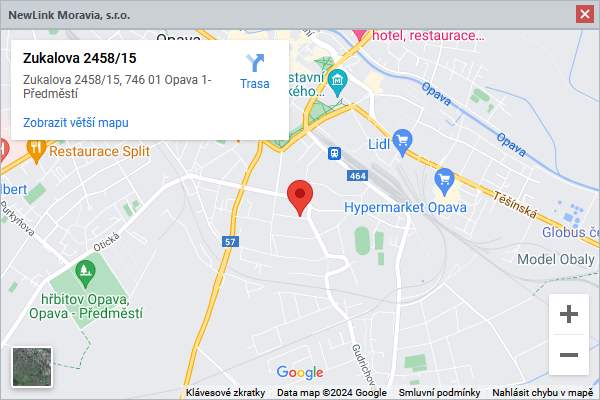

Display a map with the owner's seat marked.